I thought that I would need a root canal in at least one of my teeth. I counted on that or some other health care disaster, so I put money into my FSA account, but no such luck. My teeth stayed healthy and so did the family and we put too much into the health care savings account that I have to use or lose by March 15. This has never happened before. Maybe I should just get that root canal preemptively.

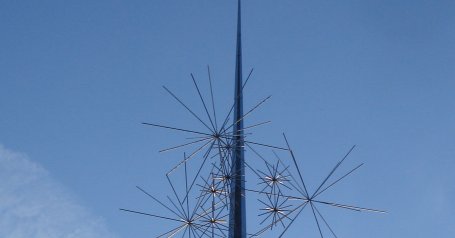

Below is a decoration at the Air & Space Museum.

The FSA is one of those heath savings accounts. They are great. They deduct money from your paycheck each week. It is tax free, with the caveat that it be used only for certified medical expenses and that it be used by March 15 of the year following when it was deducted, or else they just take it back, so you have to guess right. You can use it to pay deductibles, medicines etc. My insurance doesn’t cover most dental expenses, so I pay myself for all that Coke and Hershey cars I consumed in my misspent youth. Tooth fillings don’t last forever, and the ones I got when I was young are breaking down. I don’t fear the pain of the dentist, only the price. FSA spreads that out over the year.

Below is the National War College, T. Roosevelt Hall. The building was started in 1903 and finished in 1907.

This is the first time I have put too much money into it. Usually I don’t have enough and I get stuck with unexpected expenses, so this year I decided to be smarter. It looks like smarter was dumber. I am sure that something will go seriously wrong on March 16 and I will be stuck again.

I suppose I can stock up on aspirin, Pepto-Bismol and Nyquil, but you can only buy so much of that stuff before they suspect somebody is setting up a meth lab. It is odd to have this problem and it is better than the alternative, but I don’t want to throw away the money. I will figure something out. I suppose I can pay for something in advance.

The thing about health care is either you need it or not. It is not discretionary. I generally dislike going to doctors and avoid them if I can. My father went to the doctor only once between when he was discharged for the Army Air Corps in 1945 and when he died more than fifty years later. I am not trying to match his record but we have done all the routine checkups, even the colonoscopy I should have gotten three years ago. If medical visits can make you healthy, I am there.

As long as I am on the subject of forfeiting heath related stuff, let’s talk about sick leave. The USG gives me four hours of sick leave every two weeks. We can roll the hours over at the end of the year and I have been saving it up. I now have 2275.50 hours of sick leave saved up. If you count in paid holidays, I could be sick for around a year and a half before I ran out of sick leave. This is good. It provides a de-facto disability insurance and I don’t need Aflac. But the government, in its wisdom, has decided that it will just zero out all those hours when I retire. This is the “new” retirement system that came into force the year I joined the FS. Unused sick leave was added to your retirement in the old system. Some in Congress are talking about changing the rules for the new one, but given the hard economic circumstances I don’t suppose anything will come of it.

Frankly, this doesn’t bother me too much. They can have the sick time back; I am just glad I never was sick enough to use it up. But a significant number of people evidently view sick leave as just another form of vacation day and giving sick leave days an expiration date doesn’t encourage thrift or conservation, especially as so many employees are approaching their own expiration dates. The first generations of employees in the new system are approaching retirement and absenteeism will no doubt rise among those in the new system within a few years of retirement.